Introduction to Audio Visual Solutions in Modern Business

The modern enterprise operates in an environment where communication clarity, collaboration efficiency, and digital engagement directly impact performance. As a result, organizations increasingly rely on a trusted audio visual equipment supplier to deliver scalable, enterprise-grade solutions. The global professional audio visual systems market reflects this dependence, valued at USD 295.18 billion in 2025 and projected to reach USD 370.49 billion by 2030, growing at a 4.65% CAGR.

This sustained growth underscores the strategic role played by an AV equipment provider that delivers not only professional sound and video equipment but also long-term value through integration, maintenance, and technical support services.

What Is an Audio Visual Equipment Supplier?

An audio visual equipment supplier is a specialized audio visual technology vendor responsible for delivering complete commercial AV solutions tailored to business environments such as boardrooms, auditoriums, lecture halls, command centers, and broadcast studios.

Definition and Core Responsibilities

Unlike basic AV gear distributors, a professional AV system integrator manages the entire lifecycle of pro audio visual systems, including:

- AV system design and consulting

- Procurement and vendor management

- AV equipment installation and calibration

- SLA-backed technical support services

- Equipment maintenance contracts and firmware updates

This full-service model dominates the market, as the professional segment accounts for 73% of global AV hardware revenue (2023).

Difference Between Retailers and Professional AV Suppliers

Retailers focus on consumer-grade products. A trusted B2B audio visual equipment wholesale distributor delivers enterprise-ready systems designed for interoperability, scalability, and ROI. Notably, equipment represents 77% of the global AV hardware market, but businesses increasingly prioritize full-service audio visual integration and supply companies capable of managing total cost of ownership.

A professional B2B audio visual equipment wholesale distributor understands enterprise procurement processes, RFP requirements, compliance standards, and service-level agreements (SLAs). This distinction is critical in environments where system failure, downtime, or poor integration can result in operational disruption and financial loss.

Importance of Audio Visual Systems for Businesses

Audio visual infrastructure now forms the backbone of unified communications and digital collaboration.

Enhancing Communication and Collaboration

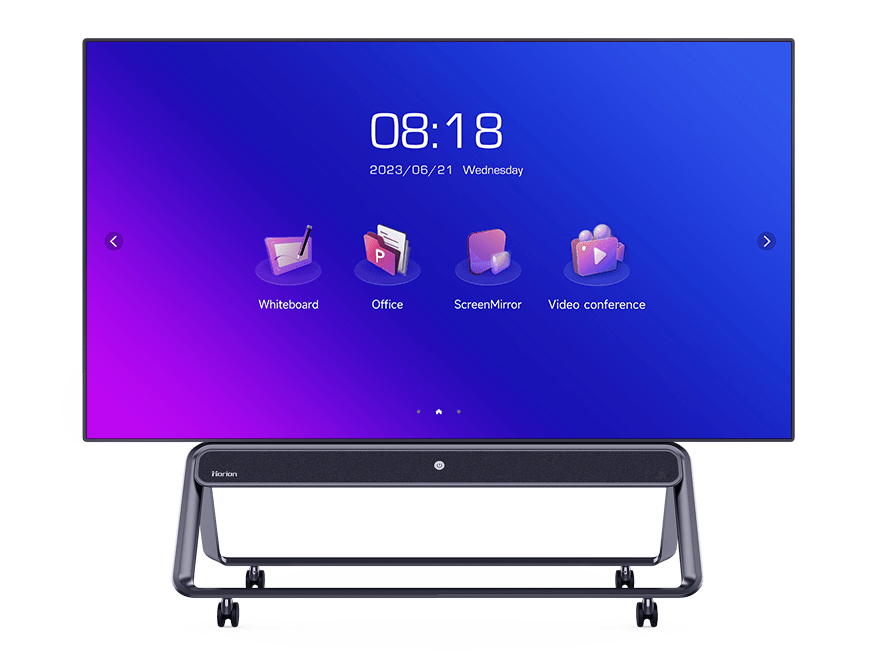

Hybrid work environments have driven demand for enterprise-grade video conferencing equipment suppliers offering Microsoft Teams Rooms equipment, Zoom-certified hardware, PTZ cameras, beamforming microphones, and DSP processors. Enterprises refresh AV systems every 3–5 years, ensuring parity across boardrooms, remote workspaces, and command centers.

Professional AV suppliers deliver enterprise-grade video conferencing equipment, including PTZ cameras, beamforming microphones, DSP processors, and cloud-based control systems. These solutions reduce friction in meetings, improve audio clarity, and ensure consistent user experiences across boardrooms, huddle rooms, and remote offices.

Improving Brand Image and Professionalism

Corporate audio visual investments account for 33.1% of global AV spending (2024)—the largest end-user share. High-quality presentation technology, wireless collaboration systems, and latency-free switching directly influence stakeholder trust and executive decision-making.

High-quality presentation technology, digital signage solutions, and conference room technology contribute directly to how stakeholders perceive an organization’s professionalism, credibility, and technological maturity.

Role of AV in Client Presentations

Visual fidelity has become a baseline expectation. Today, 60% of global display shipments are 4K, while 5–7% are 8K, reinforcing demand for LED display panels, video walls, HDMI matrix switchers, and HDBaseT-enabled distribution.

Key Characteristics of a Trusted Audio Visual Equipment Supplier

Authority in the AV industry is built on technical credibility and execution reliability.

Industry Experience and Technical Expertise

Market concentration data shows the top five manufacturers control 46% of the global AV market, emphasizing the importance of supplier alignment with brands such as Samsung, Sony, LG, Panasonic, Crestron, Barco, Biamp, and HARMAN.

This expertise allows suppliers to recommend best-fit solutions, ensure compatibility, and design systems that meet enterprise performance standards.

Certified Products and Compliance Standards

Trusted suppliers meet procurement, RFP, and government AV procurement standards, particularly as sustainability and energy-efficiency regulations tighten across Europe and Asia-Pacific.

Importance of Warranty and After-Sales Support

With 41% of organizations delaying upgrades due to rising replacement costs, robust equipment maintenance contracts, preventive servicing, and remote monitoring services have become essential supplier differentiators.

Types of Audio Visual Equipment for Businesses

Audio Systems

Audio represents 55% of total AV market volume (2024), making it the most deployed category across corporate, hospitality, and house of worship AV environments.

Professional deployments rely on microphone systems, PA sound systems, amplifier racks, DSP processors, Dante audio networking, and proper cable management to ensure consistent sound quality across spaces.

Microphone Systems, PA Sound Systems, and Amplification

Professional deployments rely on Dante audio networking, amplifier racks, rack mounting, cable management, and intelligent DSP-based processing for clarity and scalability.

Visual Display Solutions

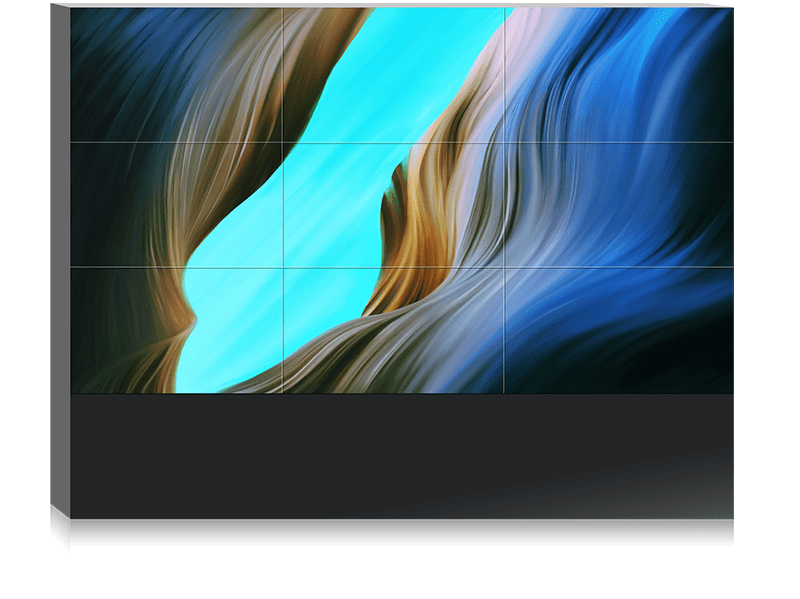

Display and projection systems account for 32.6% of global AV revenue, led by LED video walls, 4K displays, commercial projectors, and digital signage solutions.

Video walls and 4K displays are now standard in corporate lobbies, retail environments, hospitality venues, and command centers, supporting both communication and brand engagement.

LED Display Panels, Projectors, and Video Walls

Digital signage networks are now core to retail display technology, hospitality sound systems, and smart campus environments.

Conferencing and Collaboration Tools

Modern conference room technology integrates PTZ cameras, BYOD compatibility, wireless presentation systems, and cloud-based control platforms.

Audio Visual Solutions for Different Business Environments

Corporate Offices

Meeting rooms alone represent 20% of commercial AV applications, driving demand for boardroom AV integration services, wireless collaboration systems, and unified communications platforms.

Educational Institutions

Asia-Pacific holds 29.8% of global AV market share and leads growth at 5.9% CAGR, fueled by educational AV solutions, hybrid learning equipment, and smart classrooms.

Healthcare and Medical Facilities

Healthcare AV technology supports telemedicine, training simulations, and secure video collaboration across hospital networks.

Retail and Commercial Spaces

Live events and experiential environments contribute 41% of total AV market share (2023), increasing demand for event production equipment, live streaming equipment providers, and outdoor visual systems.

Custom AV Solutions vs Off-the-Shelf Equipment

Benefits of Customized AV Installations

Approximately 40% of new AV product launches now combine audio and video features, making custom AV system design and equipment supply essential for interoperability, scalability, and asset tracking.

Installation, Integration, and Maintenance Services

Site Assessment and System Design

Professional AV installation services incorporate AV-over-IP, PoE+, edge computing, and latency-free switching to reduce infrastructure complexity.

Ongoing Maintenance and Technical Support

Lifecycle services include firmware management, remote diagnostics, and SLA-backed onsite AV technical support—critical as AV processing migrates to cloud environments.

How to Choose the Right Audio Visual Equipment Supplier

Evaluating Portfolio and Client Reviews

North America holds 35% of global AV market share, with the U.S. generating $5.4 billion in AV manufacturing revenue (2025)—a benchmark for supplier maturity and vendor management excellence.

Assessing Technical Support and Scalability

In 2024 alone, USD 167 billion worth of AV equipment was supplied globally, reinforcing the need for bulk pricing, white-label solutions, and scalable deployment models.

Cost Considerations and Return on Investment (ROI)

Long-Term Value of Quality AV Systems

Although premium systems require higher initial investment, they reduce downtime, extend asset lifespan, and optimize total cost of ownership—especially under subscription-based service models.

Future Trends in Business Audio Visual Technology

Smart AV Systems and AI Integration

By 2025, 58% of new AV devices feature AI-driven automation, including intelligent noise suppression, auto-framing cameras, and real-time analytics.

Why Businesses Should Partner with a Trusted Supplier

A trusted audio visual equipment supplier with installation services becomes a strategic partner—aligning technology with business objectives, ensuring compliance, and supporting long-term scalability across boardrooms, auditoriums, broadcast studios, and live events.

Conclusion

The data confirms what enterprises already know: audio visual infrastructure is no longer optional. With market valuations projected to exceed USD 370 billion by 2030, businesses that partner with a trusted audio visual equipment supplier gain more than hardware—they secure performance reliability, future readiness, and measurable ROI across every communication touchpoint.