Introduction to Interactive Display Solutions

Interactive display solutions have become a strategic pillar of modern business infrastructure, redefining how organizations communicate, collaborate, and engage with audiences. Unlike traditional static displays, interactive display solutions integrate touchscreen technology, interactive visualization systems, and smart display technology to create dynamic, two-way communication environments. These systems allow users to interact directly with digital content through touch, gestures, or connected devices, making information exchange more intuitive and impactful.

The rapid adoption of interactive display solutions is strongly reflected in market data. The global interactive display market is projected to grow from USD 13.41 billion in 2025 to USD 16.9 billion by 2029, registering a 6.3% compound annual growth rate (CAGR). When viewed within the broader commercial display ecosystem, growth appears even more substantial, with the market expected to reach USD 55 billion by 2035. These figures underscore the growing reliance of businesses on interactive digital boards, touch-enabled monitors, and immersive display systems to support digital transformation initiatives.

Evolution of Business Communication Technologies

From Static Signage to Interactive Visual Communication

Business communication has evolved significantly over the past two decades. Early communication relied on printed posters, static signage, and basic digital screens that delivered information passively. While effective for basic messaging, these formats lacked adaptability, personalization, and user engagement. Today, organizations are transitioning toward interactive visual communication platforms that enable real-time interaction and content customization.

This shift is closely tied to the growth of the commercial display market, which is forecasted to expand from USD 27.7 billion in 2025 to USD 29.6 billion in 2026. Within this market, interactive whiteboard systems are the fastest-growing segment, recording an 8% CAGR. The widespread adoption of multi-touch interfaces, gesture-controlled displays, and collaborative touchscreen displays reflects a fundamental change in how information is shared and consumed in professional environments.

Digital Transformation and Smart Display Adoption

Digital transformation initiatives have accelerated the adoption of interactive display solutions across industries. Cloud computing, artificial intelligence (AI), and Internet of Things (IoT) technologies are increasingly integrated into display ecosystems, enabling seamless connectivity and intelligent data visualization. Smart technology integration accounts for approximately 30% of overall market growth, highlighting the role of digital collaboration tools and interactive presentation technology in modern workplaces.

What Are Interactive Display Solutions?

Definition and System Architecture

Interactive display solutions are advanced, commercial-grade visual systems that enable direct user interaction with digital content. These solutions typically combine touch-sensitive display panels, embedded computing power, and software platforms that support collaboration, analytics, and remote management. Their architecture is designed to support human-machine interface (HMI) display solutions, ensuring intuitive interaction across diverse use cases.

Hardware Infrastructure and Touch Technology

Hardware forms the foundation of interactive display solutions. LED displays dominate the market, generating approximately USD 7.8 billion in revenue in 2025. Their dominance is attributed to high brightness levels, wide viewing angles, ruggedized construction, and energy efficiency. LED technology can reduce energy consumption by up to 40%, a critical advantage as 68% of businesses prioritize energy efficiency when investing in display solutions.

Advanced touch sensor technology, including capacitive touch, infrared touch frames, and pressure-sensitive overlays, enables accurate multi-user interaction. These innovations support precise touch display calibration, even in large-format interactive displays used in corporate and public environments.

Software Platforms, Cloud Management, and Integration

On the software side, interactive displays rely heavily on digital signage software, display management software, and content management systems (CMS). Approximately 73% of digital signage deployments now use cloud-based management, allowing organizations to update content remotely, monitor performance, and scale deployments efficiently. Cloud platforms also enable API integration, real-time analytics, and seamless connectivity with enterprise systems.

Types of Interactive Display Solutions

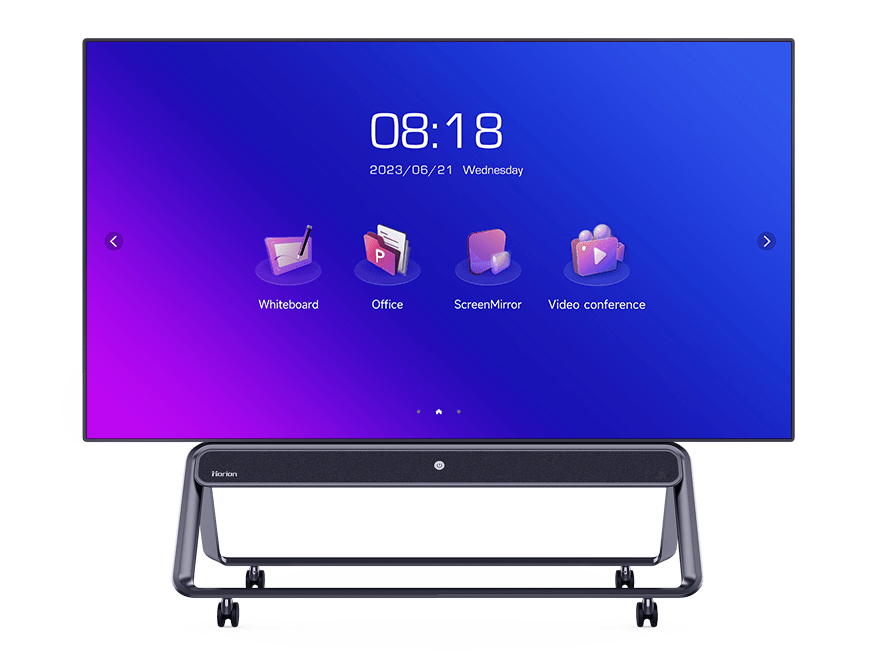

Interactive Flat Panels and Smart Board Alternatives

Interactive flat panels are widely deployed in corporate meeting rooms, boardrooms, and educational institutions. Often positioned as smart board alternatives, these displays combine high-resolution screens with multi-touch functionality and interactive presentation software. Their adoption is driven by hybrid work models and digital learning environments, which now contribute 25% of overall market growth.

Interactive Digital Signage Systems

Interactive digital signage solutions represent 27.3% of the commercial display market, valued at USD 7.6 billion in 2025. These systems are commonly used in retail, hospitality, transportation, and corporate branding environments. By integrating content management systems, audience analytics, and AI-driven personalization, interactive digital signage enhances customer engagement and supports data-driven marketing strategies.

Touchscreen Kiosks and Wayfinding Displays

Interactive kiosk hardware ranks among the top five display formats in retail and transportation sectors. These systems are increasingly used for self-service applications, including ticketing, ordering, and interactive wayfinding displays for hospitals. Improvements in gesture recognition and touch interface design have driven 25% faster adoption rates, particularly in high-traffic public spaces.

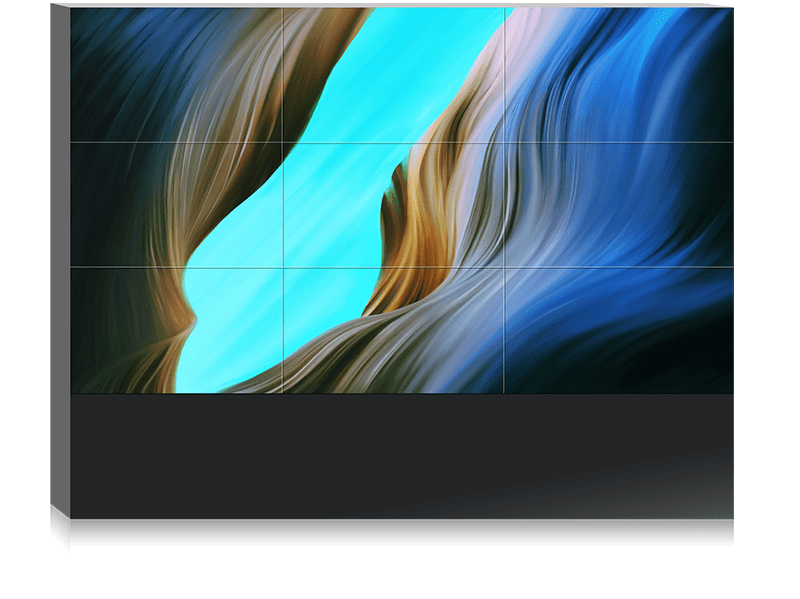

Video Walls and Interactive Tables

Interactive video wall solutions for control rooms and corporate lobbies are gaining traction due to their ability to visualize complex data at scale. Meanwhile, interactive tables are emerging in hospitality and collaborative workspaces, enabling multi-user interactive display solutions with simultaneous touch and immersive group interaction.

Core Technologies Driving Market Adoption

4K, 8K, and Large-Format Interactive Displays

High-resolution displays play a critical role in modern interactive systems. The integration of 4K UHD and 8K resolution accounts for approximately 30% of market growth in high-end corporate deployments. Large-format interactive display solutions, including 85-inch and larger screens, are increasingly deployed in conference rooms, control centers, and executive briefing spaces.

Artificial Intelligence, Analytics, and Personalization

AI-powered interactive visualization systems enable real-time content personalization, behavioral analysis, and performance measurement. Data-driven campaigns powered by analytics perform 41% better than traditional approaches, and 85% of enterprise digital signage solutions include advanced analytics. These capabilities allow organizations to measure ROI, optimize content, and improve user experiences continuously.

Business Benefits of Interactive Display Solutions

Enhanced Customer Engagement and Experience

Interactive display solutions significantly enhance customer engagement by transforming passive viewers into active participants. Organizations adopting AI-enabled interactive digital signage report 28% higher customer engagement, while personalized content delivery increases viewer attention by up to 60%. These outcomes demonstrate the effectiveness of immersive display systems in customer-facing environments.

Revenue Growth and Measurable ROI

Retail deployments of touchscreen display solutions for retail stores have demonstrated strong financial returns. Analytics-driven signage initiatives have generated USD 15 million in incremental revenue, with campaign effectiveness improving by 32%. These metrics highlight the revenue-generating potential of interactive display investments.

Operational Efficiency and Cost Optimization

Cloud-based display management delivers 50% faster content updates and reduces total cost of ownership by 35%. Energy-efficient LED displays further support cost savings, reinforcing the business case for commercial-grade interactive displays.

Industry-Specific Applications

Retail, Hospitality, and Customer Engagement

Retail remains the largest adopter of interactive digital signage solutions, with 45% of retailers planning AI-powered deployments by 2026. In hospitality, digital signage solutions enhance guest experiences through interactive menus, wayfinding, and self-service kiosks, supporting personalization and operational efficiency.

Corporate, Enterprise, and Hybrid Workspaces

Interactive display solutions for corporate meetings and conference room interactive screens support wireless presentation, screen sharing, and seamless integration with collaboration platforms. These systems enable real-time collaboration and improve productivity in hybrid work environments.

Education, Training, and E-Learning

Educational interactive whiteboard solutions for classrooms are transforming teaching and learning experiences. These touchscreen teaching tools support hybrid learning models, interactive lessons, and improved student engagement across schools and universities.

Healthcare and Public Sector

Healthcare interactive display solutions support patient education, wayfinding, and operational efficiency, positioning healthcare as a high-growth vertical for interactive display technologies.

Regional Market Dynamics

North America

North America accounts for 27.3% of the global commercial display market, with the U.S. market valued at USD 6.0 billion in 2025 and expected to reach USD 6.4 billion in 2026. Growth is driven by enterprise digital signage, digital-out-of-home advertising, and regulatory compliance initiatives.

Europe

Europe’s market reached USD 5.7 billion in 2025, led by Germany’s industrial digitization efforts and emphasis on energy-efficient interactive displays for smart factories and transportation hubs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, recording an 8.1% CAGR, supported by rapid urbanization, smart city projects, and government-led digitization in education and public infrastructure.

Market Drivers and Demand Factors

Market growth is driven by multiple factors, including 35% contribution from digital signage demand, 30% from smart technology integration, 25% from education and corporate digitalization, and 10% from government innovation programs. Consumer expectations further accelerate demand, with over 90% of customers preferring personalized digital content.

Competitive Landscape

The interactive display market is moderately consolidated. Samsung Electronics leads with a 15.8% market share, while the top five players collectively control 56.7% of the market. The competitive ecosystem includes display manufacturers, software providers, and system integrators delivering end-to-end interactive display solutions for business.

Challenges and Constraints

Despite strong growth, the market faces challenges such as rising production costs, supply chain disruptions, and a shortage of skilled installation professionals. Regulatory requirements related to accessibility and data privacy also influence deployment strategies and investment decisions.

Sustainability and Energy Efficiency

Sustainability has become a critical purchasing criterion. LED interactive displays reduce energy consumption by up to 40%, and sustainable solutions are adopted 25% faster than traditional displays. Renewable energy-powered outdoor displays are increasingly used in smart city initiatives.

Future Outlook and Technology Investment

By 2026, 45% of retailers plan AI-powered display deployments, while 73% of systems already use cloud-based management and 85% integrate advanced analytics. Emerging innovations such as AR/VR-enabled collaboration displays, transparent OLEDs, and MicroLED technology are expected to define the next generation of interactive display solutions.

Conclusion

Interactive display solutions have evolved into essential business assets that combine touchscreen technology, digital collaboration tools, and interactive visualization systems to deliver measurable ROI. Supported by strong market growth, advanced analytics, and sustainability-driven innovation, these solutions empower organizations to enhance engagement, improve operational efficiency, and maintain competitive advantage in an increasingly digital-first global economy.