Introduction to Smart Workspace Evolution

The modern workplace is experiencing a fundamental transformation. Traditional offices built around fixed desks, projectors, and physical whiteboards are rapidly giving way to intelligent environments designed for flexibility, collaboration, and digital efficiency. This shift is driven by hybrid work models, cloud-based collaboration platforms, and the growing need for seamless communication across distributed teams. At the center of this evolution stands the meeting room touch screen, a technology that has become essential to the functioning of smart workspaces.

Smart offices are no longer measured solely by aesthetics or square footage. Instead, their value lies in how effectively technology enables people to work together. Market data strongly reflects this transition. The global smart office market, currently valued between USD 50.17 and 53.9 billion, is projected to surpass USD 113 to 128 billion by 2033, growing at a compound annual growth rate (CAGR) of up to 13.9%. A significant portion of this growth is attributed to investments in smart meeting room solutions, including interactive displays, wireless presentation systems, and integrated audiovisual platforms.

Within this ecosystem, meeting room touch screens serve as the primary interface between users and collaboration technology. They enable organizations to move beyond static presentations and toward truly interactive, data-driven, and inclusive meetings.

Understanding the Role of a Meeting Room Touch Screen

A meeting room touch screen is not merely a replacement for a projector or monitor. It represents a convergence of display technology, touch interaction, software integration, and network connectivity into a single, unified collaboration platform. As organizations adopt digital-first strategies, these displays have become indispensable tools for communication and decision-making.

What Is a Meeting Room Touch Screen?

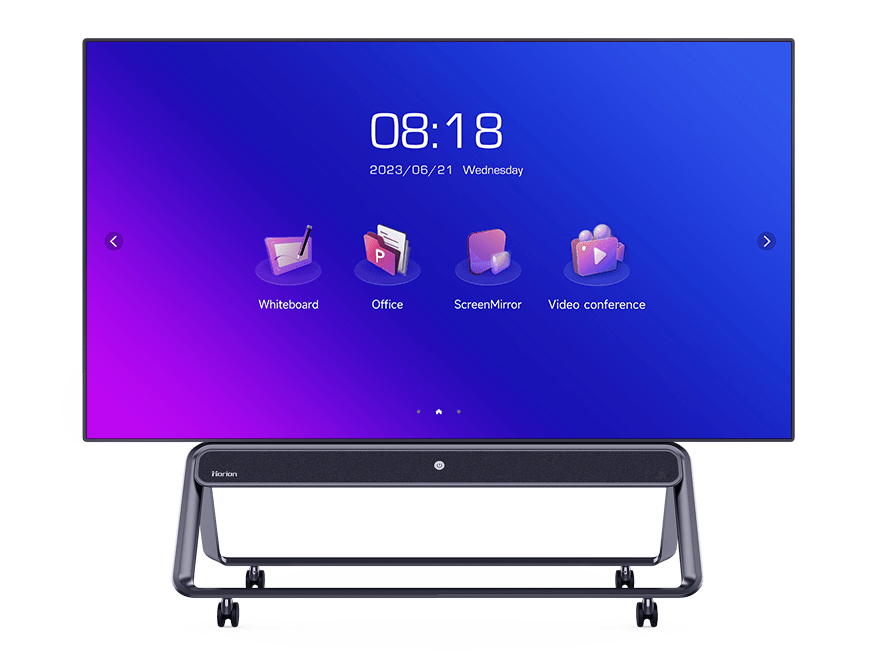

A meeting room touch screen is a large-format, touch-enabled display designed specifically for professional collaboration. Often referred to as an interactive meeting room display, conference room digital whiteboard, or interactive flat panel display (IFPD), it allows users to present content, annotate documents, brainstorm ideas, and conduct video meetings directly on the screen.

Unlike consumer-grade touch screens, these displays are built for continuous commercial use. They support multi-touch gestures, stylus input, wireless casting, and integration with enterprise collaboration platforms such as Microsoft Teams, Zoom, and Google Meet. As a result, they function as touchscreen presentation systems, digital collaboration boards, and video conferencing displays within a single device.

The rapid adoption of these systems is reflected in the broader interactive display market, which is projected to grow from USD 48.29 billion in 2025 to USD 71.26 billion by 2030, at a CAGR of 8.08%. Interactive flat panel displays account for the majority of this growth due to their versatility and reliability in business environments.

Market Momentum Behind Interactive Displays

The commercial relevance of meeting room touch screens is further reinforced by the expansion of the meeting room display solution market, currently valued at USD 2.81 billion and expected to reach USD 7.50 billion by 2035, growing at a 9.3% CAGR. This growth is fueled by enterprise modernization, smart office initiatives, and the increasing complexity of collaboration needs.

Organizations are no longer satisfied with basic presentation tools. They require interactive screens for business that support real-time collaboration, reduce meeting setup time, and integrate seamlessly with existing IT ecosystems. As a result, meeting room touch screens have become central to long-term workplace technology strategies.

Why Smart Workspaces Depend on Touch-Enabled Displays

Smart workspaces are designed to eliminate friction. Every delay caused by cables, incompatible devices, or technical issues reduces productivity and disrupts meeting flow. Touch-enabled displays address these challenges by simplifying how teams interact with information and with one another.

Hybrid Work as a Structural Growth Driver

Hybrid work is no longer an exception; it is the standard operating model for many organizations. This shift has accelerated demand for smart meeting room solutions that ensure equitable participation for both in-room and remote attendees. The smart meeting room solutions market is projected to reach USD 4.9 billion by 2030, expanding at a notable 16% CAGR.

Meeting room touch screens play a critical role in enabling hybrid collaboration. They allow remote participants to view annotations in real time, join whiteboarding sessions, and engage with shared content as if they were physically present. In this context, the touch screen becomes a bridge between physical and digital workspaces.

The Cost of Inefficient Meetings

Inefficient meetings impose a substantial financial burden on organizations. In the United States alone, unproductive meetings cost businesses approximately USD 34 billion annually. Much of this cost stems from poor room utilization, technical delays, and lack of engagement.

By implementing meeting room touch screens, wireless presentation displays, and digital collaboration boards, organizations can significantly reduce these inefficiencies. Studies show that smart room optimization can deliver 15–25% cost savings, while also improving meeting outcomes and participant satisfaction.

Display Technology Behind Modern Meeting Room Touch Screens

The effectiveness of a meeting room touch screen depends heavily on its underlying display and touch technologies. Understanding these components is essential for making informed purchasing decisions.

Display Panel and Backlight Technologies

In 2024, LCD panels with LED backlights dominated the interactive display market, accounting for 61.8% of market share. Their popularity is driven by cost efficiency, consistent performance, and a mature manufacturing ecosystem. LCD-based interactive displays are widely deployed in corporate meeting rooms, training centers, and educational institutions.

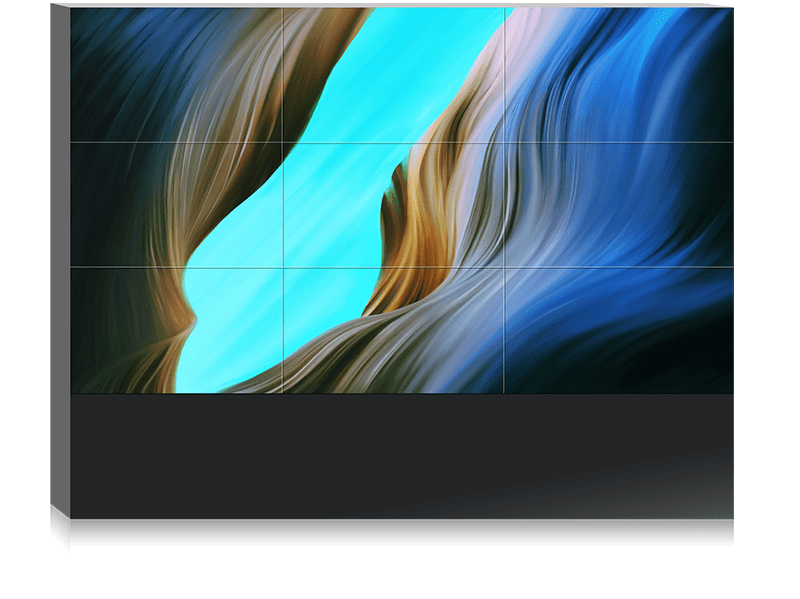

At the same time, direct-view LED displays are emerging as the fastest-growing segment, expanding at a 9.5% CAGR. These displays offer superior brightness, modular scalability, and longer lifespan, making them attractive for premium boardrooms and large executive spaces.

OLED displays remain a niche option, valued for their exceptional contrast and color accuracy. They are typically used in high-end environments where visual quality is a top priority.

Touch Technology: Capacitive vs Infrared

Touch interaction is what transforms a display into a collaboration tool. Currently, infrared touch technology leads the market with 45.9% share, largely due to its durability and ability to support multiple touch points simultaneously. Infrared systems are commonly used in large-format interactive displays.

Capacitive touch technology, growing at a 9.3% CAGR, provides a more fluid and responsive experience similar to smartphones and tablets. This technology is increasingly favored in premium interactive flat panel displays used for executive collaboration.

Resistive touch technology continues to serve budget-sensitive environments, though its role is diminishing as organizations prioritize user experience and responsiveness.

Screen Size and Resolution Trends in Conference Rooms

What Size Touch Screen for a Conference Room?

Choosing the correct screen size is critical to usability. Displays in the 32″ to 65″ range account for 54.2% of total revenue, making them ideal for small and medium-sized meeting rooms. These sizes are particularly popular in huddle spaces and agile collaboration areas.

However, demand for large format touchscreens is growing rapidly. Displays above 65 inches represent the fastest-growing category, expanding at a 12.4% CAGR. In interactive whiteboard applications, 70″–90″ displays already account for 44.15% of revenue, while 90″+ screens continue to gain traction at a 9.8% CAGR.

4K vs 1080p Interactive Displays

Resolution has become a decisive factor in purchasing decisions. 4K meeting room displays dominate the market with a 57.2% share, offering sharper visuals and improved readability for detailed content. Screens larger than 65 inches account for 54.9% of total display revenue, reinforcing the importance of high resolution in larger spaces.

Industry Adoption of Meeting Room Touch Screens

Vertical-Specific Usage Patterns

The education sector leads adoption, accounting for 40.8% of interactive display revenue. Institutions rely on interactive displays for digital learning, training, and collaborative instruction. The corporate and government sectors, together representing nearly 30%, use meeting room touch screens to support strategic planning, client presentations, and internal collaboration.

Healthcare is emerging as a high-growth vertical, with video hardware adoption growing at 17.1% CAGR, driven by telemedicine, clinical collaboration, and training requirements.

Conference Room Solutions by End Use

Corporate enterprises generate approximately 40% of total conference room solution revenue, reflecting the scale of enterprise deployments. Educational institutions remain the fastest-growing segment, while healthcare organizations continue to modernize collaboration spaces to support digital workflows.

Regional Market Distribution and Global Growth

Geographic Adoption Trends

North America leads the market with 34–39.83% share, driven by early adoption and enterprise upgrades. The Asia-Pacific region, accounting for over 30%, is the fastest-growing, with growth rates reaching 12.5% CAGR due to rapid digital transformation.

Europe maintains steady growth, emphasizing sustainability and energy-efficient AV technologies. Meanwhile, Middle East & Africa and Latin America are experiencing increased adoption through smart city initiatives and digital education investments.

Country-Level Growth Insights

Countries such as India (16.5% CAGR) and China (14.9%) are expanding rapidly, supported by infrastructure development and hybrid work adoption. The United States (12.3%) continues to modernize legacy meeting room technology across enterprises.

Technology Ecosystem and Market Leaders

The smart meeting room ecosystem includes global leaders such as Microsoft, Zoom, Cisco, Logitech, Samsung, LG, and Crestron. Microsoft Teams Rooms, with over 1 million active rooms globally, exemplifies the scale of platform-driven collaboration.

In the interactive display segment, manufacturers such as ViewSonic, BenQ, SMART Technologies, NEC, and Avocor offer enterprise-grade Surface Hub alternatives designed for scalability and performance.

Meeting Room Booking, Connectivity, and Infrastructure

Room Scheduling and Utilization

The meeting room booking system market, valued at USD 1.36 billion, is expected to grow to USD 3.12 billion by 2032, at a 10.95% CAGR. Cloud-based systems dominate with 55% market share, reflecting the shift toward centralized workspace management.

Connectivity and AV Backbone

Despite wireless advancements, wired connectivity remains essential, accounting for 56.46% of the market. Supporting infrastructure markets include Ethernet cables (USD 11.5 billion), HDMI cables (USD 3.17 billion), and wired conference microphones (USD 1.7 billion).

Pricing Structure and ROI Considerations

In a typical meeting room deployment, hardware represents 43–55% of total cost, while software is the fastest-growing component at 18.8% CAGR. Integration services remain critical for ensuring reliability and scalability.

Declining costs for 90″+ interactive displays are improving accessibility, making premium collaboration environments achievable for a wider range of organizations.

Emerging Trends in Meeting Room Technology

Artificial intelligence is rapidly reshaping collaboration. Over 72% of new platforms now include AI-driven features such as real-time transcription, smart summaries, and participant analytics. Technologies like AV-over-IP, cloud-based UCaaS, IoT integration, and 8K resolution are converging to define the next generation of meeting room AV technology.

Challenges and Market Constraints

Despite strong growth, challenges remain. High initial investment, interoperability across platforms, data security concerns, and skills shortages can slow adoption. Supply chain volatility and component availability also affect deployment timelines, particularly for large-scale projects.

Conclusion: The Strategic Importance of Meeting Room Touch Screens

The meeting room touch screen has evolved into a strategic asset that underpins modern collaboration. With the total addressable market across smart offices, AV services, and collaboration platforms projected to exceed USD 150 billion by 2030, organizations that invest in interactive meeting room technology gain long-term competitive advantages.

By integrating interactive flat panel displays, wireless presentation systems, AI-powered collaboration tools, and cloud connectivity, meeting room touch screens are redefining how businesses collaborate, innovate, and scale in the digital era.